The Issue of Black Money in India: A study on its movement and implications on the Indian economy.

March 19, 2014 Leave a comment

January 2014

As presented at the International Conference on Money, Finance and Economic Growth: Emerging Issues. Thane, India.

ISBN 978-81-922741-2-6

Abstract

Various claims have been made in the past about the effect of Indian black money on the Indian economy, as well as its effect on the standard of life if it were to be routed back to the country by the government. It also has been asserted that the current financial disorder is a result of the diversion of black money from the country. Politicization of the issues has meant that the public has been wronged about the implications of black money on the economy. FDI has also received a lot of criticism for its implementation by the government. This study tries to show the movement of Indian black money in foreign markets. While it shows its movements, it also intends to draw out its implications on the Indian economy. It also outlines the role of FDI in routing black money back into the economy.

1. Background

Claims have been made in the past by opposition parties in the Indian polity, that by bringing back the black money of the country from the tax havens across the globe, the standard of living would dramatically increase. It also has been asserted that the current financial disorder is a result of the diversion of black money, also referred to as the underworld economy.

2. Introduction

Black money, or ‘unaccounted income’, ‘black income’, ‘dirty money’, black wealth’, ‘underground wealth’, ‘black economy’, ‘parallel economy’, ‘shadow economy’, ‘underground/unofficial economy’, is defined as “proceeds, usually received in cash, from underground economic activity”. Such a term is usually not used in economic theory, but is informally referred so. The extent of black money deposited in tax havens are estimated to be `9,295 crore for the year 2010 by the Swiss National Bank, that is 0.13 percent of the total deposits of all the nationals held in Swiss Banks. The myth that India has a substantial amount of currency in Swiss Banks is falsified by the White Paper on Black Money published by the Ministry of Finance, Government of India in May 2012. This document further goes on to claim that the black money by Indian deposits in Swiss Bank accounts were to the tune of `23,373 crore in the year 2006, that is 0.29 percent, which is still unsubstantial in the contexts Indian black money held in Swiss Banks.

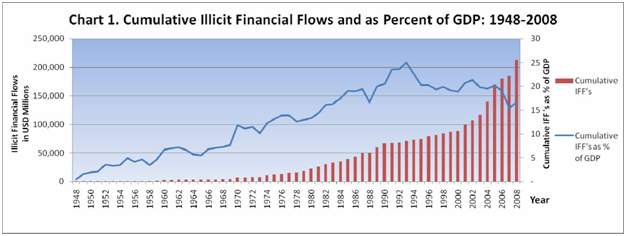

However, according to a study shown by Dev Kar and Cartwright-Smith, India has lost around US$23.7 to US$27.3 billion annually in illicit financial flows in the period of 2002-06. The same study also showed that in the period of 1948-2008, US$213.2 billion has been shifted out of India. This same amount, if halved and compound interest would be calculated, would amount to a staggering US$462 billion as of end-December 2008. This would’ve been sufficient to liquidate India’s external debts that amounted to US$230.6 billion at that same juncture.

An estimate has further gone on to project that the total amount of India’s underground economy should be US$640 billion dollars in 2008, which is around 50 percent of the total GDP.

In 2009, before the General Elections in India, Sharad Yadav of the JD(U), a then member of the opposition NDA alliance, claimed that the black money held in Swiss Banks by Indian nationals were to the tune of US$1.46 trillion dollars, which is more than the actual size of GDP. This report was published following circulations being forwarded on various portals of the same data. This data was later scrapped in the GoI’s White Paper on Black Money, published in May 2012. Furthermore, overhyped claims after the politicization of the issue has asserted in unrecognized news portals that the black money which has been estimated at around 40 percent of the total GDP can be distributed, by which every citizen can get a monthly income of `2000 for a span of 60 years. Also the money can create much needed jobs to the extent of 60 million fresh openings. While the calculations on these facts might be certified as feasible, it is uneconomic altogether.

In an article by the Indian Express, it was reported that the Swiss National Bank figures showed Indian black money at US$3 billion in 2008, US$2.7 billion in 2009 and US$2.5 billion in 2010. Sources, according to the report, stated that the steady decline in the Swiss deposits over the years might be due to growing pressure on Swiss banks from the Indian polity, and the funds have been transferred to safer tax havens such as Dubai, Mauritius, Singapore and other regions in the Middle-East. But due to vigilant regulators such as RBI and SEBI, the deposits in the Middle-East are seeing a spurt, while they are being routed back in the recent times, through either FIIs or FDIs.

In another article by the Economic Times, the Foreign Tax and Tax Research (FT&TR) in 2013, made approaches to the lesser known tax havens, to which most of the black money which had speculatively been moved to from Swiss and Dubai Banks. The reported places that were approached were Singapore, British Virgin Islands, Cayman Islands, Cooks Islands and Samoa; this after the International Consortium of Investigative Journalists (ICIJ) expose of secret offshore accounts held by individuals from the cities of Delhi, Bangalore, Kolkata, Chennai, Hyderabad, Pune, Ahmedabad, Baroda, Surat, Chandigarh and a few other cities.

3. Means of redirecting Black Money back into India

Redirecting black money back into India can be done in three ways, which is by legislation, judiciary or by economic policy. The methods by legislation can be by way of declaring the black money as a national asset either by passing a law in the parliament, or by the Supreme Court ruling. The methods by judiciary is as already mentioned above, that is by government intervention and approaching respected countries to persuade and make co-operate those countries to make-know of the details of amount of assets hoarded, etc. While both these methods can be rigid and ineffective, they can also be virtually impractical given their indirect touch. A more effective means of redirecting black money back is by economic policy, and is most effective off-late in the form of Foreign Direct Investments (FDIs).

4. Foreign Direct Investments (FDIs)

It is “an investment made by a company or entity based in one country, into a company or entity based in another country.” FDI has been a major economic policy in the Indian economy. It was first introduced in India among the 1991 economic reforms penned as the Foreign Exchange Management Act (FEMA). In 1997, FDI in cash and carry (wholesale) was permitted through the Government route. In 2006 it brought under Automatic route, and FDI in single brand retail with 51 percent investment was permitted. In September 2012, a bill on FDI in multi-brand retail was passed, that enabled 51 percent ownership on retail chains in India.

5. Returning trend of Black Money via FDI

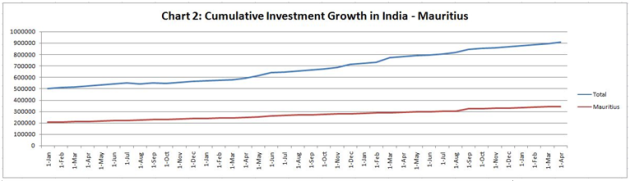

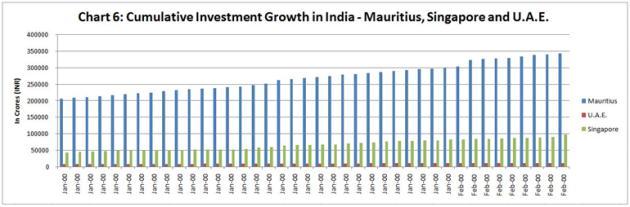

The growth in FDI in India has been noteworthy in the past few years, not particularly due to the passing of these various laws in the realm of Foreign Investments, but for the investments made into the economy by the tax havens that have been held in the radar of the Indian government. Data maintained by the Department of Industrial Policy and Promotion (DIPP) of the Ministry of Finance, shows a telling trend in the same. It is important to note that Mauritius, Singapore, British Virgin Island, U.A.E. have all been well-known tax havens, the case of Cyprus is an uncertain one, however, it shall be presented here for the sake of justice of argument.

- Mauritius

Mauritius is a tiny country on the Indian Ocean, whose economy accounts to less than a hundredth of the Indian economy, and yet it is one of the largest investors in FDI in India. According to the Department of Industrial Policy and Promotion (DIPP), as of April 2013, Mauritius has an investment total amounting to `3.4 lakh crores or US$74 billion, which is 38 percent of the total investments made among all foreign entities, while the second-highest holds only 11 percent of that stake.

Mauritius has toughened its role in helping the Indian government trace down erring financial agents in the nation in the recent past, it has also shown positive responses in cases of government correspondences et al.

On August 6, 2012, Firstpost.com reported that Mauritius-based financial entities off-loaded shares to the tune of `3,000 crore in the period of April-1-2012 to August-6-2012. This was found to be highly contrasting of the share purchases in the same period that amounted to a total of `600 crore, translating to a net outflow of over `2,200 crore. These developments have all been in the wake of a toughened stand on black money by the two countries.

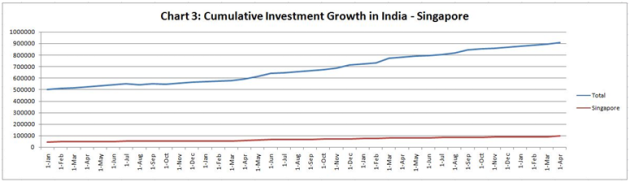

- Singapore

Singapore is a small island nation on the southern tip of the Malay Peninsula. With a geographical area of 720 sq.kms, and a measly population of 5,312,400, it is pegged as the fastest growing tax havens in the world, and assumed to topple Switzerland as a major tax haven by 2020. According to the DIPP FDI data, Singaporean financial entities have a total investment of `97,214 crore or US$20.7 billion, standing second to Mauritius in the total nation-wise total investments in India. However, the trend seems to see a lesser growth than Mauritius with an average `1,365.35 million increase in the total investment, in the period of the surveyed 40 months, when compared to Mauritius’ average of `3,407.4 million increase.

However, President Lee Hsien Loong of Singapore, asserted that Singapore wasn’t a destination for tax-laundering activities of erring individuals in India. In justification to his argument, it is also noteworthy that the Governments of India and Singapore had entered into an agreement for avoidance of double taxation and prevention of fiscal evasion with Singapore (DTAA) on 27th May, 1994 that has been amended at various occasions, including one off-late in 2005.

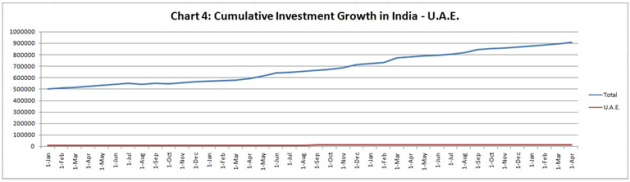

- U.A.E.

This includes the investments from all the emirates of the U.A.E., inclusive of the seven emirates, Abu Dhabi, Dubai, Sharjah, Umm al-Quwain, Ajman, Ras al-Khaimah and Fujairah. Although it is largely publicized that Dubai is a tax haven, Abu Dhabi is also a potential target as a tax haven[i], and as Dubai and Abu Dhabi constitute for a majority GDP in the U.A.E, it is safe to assume that the U.A.E. has a proportion of Indian black money.

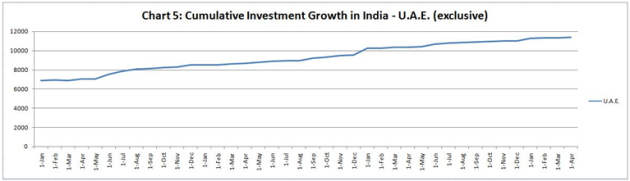

According to the study by data obtained from the DIPP on FDI, U.A.E. has shown the least amount of total foreign investments, among the countries studied, ranking a lowly 10 on the April 2013 survey of the DIPP at a meager `11,363 crore or US$2.4 billion, with an average monthly growth of `284.08 and a mere 1 percent of the total investments.

For the sake of clarity of the graph, Chart 5 below demonstrates the singular trend of U.A.E.’s FDI growth.

6. Implications on the Economy

With the extent of exported Indian black money being to the tune of US$462 billion, it is evident that this has created serious faults in the monetary system.

- Currency deflation is caused by unequal balance of payments. When the monetary authority produces more currency units and pumps it into the system, the unaccounted money is not taken into consideration. Under such a situation, the currency value depreciates in the global market, and hence causes currency deflation.

- Inflation is a major and an evident implication on the economy. Huge inflows of unaccounted money converts desires into demands and postpones the dip in the demand curve, while the supply stays the same or barely rises (at its peak), in response, creating disorder and ultimately a hike in the prices to meet the demand. The amount of proportion of unaccounted money to the accounted money can lead to reciprocating effects on price levels.

- The calculations of the policy-makers with respect to the fiscal measures undertaken periodically can be significantly affected with misappropriated monetary assets accounted during that period. This can severely affect the economic system of that economy in the future years, by forces outside of that economy; especially the monetary denomination.

- Investment of black money into another country can mean a rise in growth and productivity of that country. Employment increases, wages are upgraded, output swells and exports flourish. Also, growth rates escalate quickly for that period.

7. Conclusion

With Black Money being routed out of India through a passage left unchecked by the judiciary system, there exist major flaws in the economic policy of the country. The issue of Black Money in tax havens is a serious issue to the economy, as it empowers economic freedom to the various tax havens in which a huge chunk of the Indian currency deposits lie. With Swiss Bank’s estimates of `9,295 crore worth of Indian black money held with its banks in 2010, the next bid goes to Mauritius as being the highest holder of Indian black money in today’s age, with a total of `3.4 lakh crore worth of investment entering India till April 2013, which is 37 times larger than the total amount of Indian deposits held in Swiss Banks. Dubai, on the other hand, has shown an unclear trajectory with regards to FDIs. While it was claimed that Dubai has a significant proportion of black money, if true, it has not been routed back through FDI. It has either been transferred to another tax haven, or has been invested in a foreign land. Singapore shows an interesting graph at `97,214 crore investments to-date. While Singapore can be ascertained to be a far advanced economy in comparison to Mauritius, is should also be noted that the investments are more substantial to the ones made by U.S.A. and the U.K. (both who stand at 3rd, 4th and 5th positions in the period, ahead of Singapore’s 2nd on the FDI stats), both of whom have more economic interests in India than Singapore. Hence, it can be assumed that a proportion of the black money is returning back through the Singapore route as well.

REFERENCES

“Bring back India’s money in foreign banks: Advani.” Times of India, Mar 29, 2009.

“Black money in Swiss banks can cross $2.5 bn estimate” The Indian Express, Jul 24, 2011.

“India approaches tax havens on global black money expose” The Economic Times, Jun 16, 2013.

“Black Money: Indian fund flows are dealt with more carefully, says Mauritius” The Economic Times, Nov 2012.

“Sharing information on black money with India: Mauritius” The Hindu, Feb 21, 2011.

“Black money link? Mauritius entities on a selling spree in India” Firstpost.com, Aug 6, 2012.

“Singapore to eclipse Switzerland as tax haven by 2020” CNN, May 14, 2013.

“It’s wrong to cite Singapore in white paper money on black money: Hsien Loong, Prime Minister, Singapore” The Economic Times, Jul 13, 2012.

“Tax Havens: How Globalization Really Works” Ronen Palan, Richard Murphy and Christian Chavagneux. ISBN-13: 978-0801476129.

FDI Statistics – The Department of Industrial Policy and Promotion (DIPP).

White Paper on Black Money (2012) – Ministry of Finance, Government of India.

The Drivers and Dynamics of Illicit Financial Flows from India: 1948-2008 (Nov 2010) – Dev Kar.